proposed estate tax changes october 2021

The taxable estate is taxed at 40. Reduction in Estate and Gift Tax Exclusion.

Time To Change Your Estate Plan Again

I actually got a capital loss when I sold it Mr.

. The exemption applies to total bequests. The Budget increases New York States current maximum tax rate on individuals from 882 to 965 for the 2021-2027 calendar years. Biden has said the federal exemption level for the estate and gift taxes should be decreased.

The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted effective January 1. It kicks in at 400000 of income for an individual and 450000 for a. The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of the Lifetime Exemption.

Estate and gift tax exemption. Stepped-up basis refers to having the propertys usual inherited basis increased or. Is 117 million in 2021.

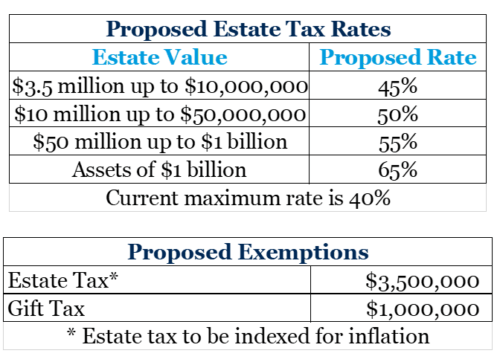

The House Ways and Means Committee released its tax law proposal the House Proposal to be incorporated in a budget reconciliation bill on Monday September 13 2021. The proposed top income tax rate of 396 percent looks like the old top rate of 396 percent from 2017. Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021.

Personal Income Tax Increases. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. The bill would dramatically reduce the federal estate and gift tax exclusion from its current level of 117.

That is only four years away and. Oregon Supreme Court upholds including out-of-state QTIP trust in surviving spouses estate In Estate of Evans v. This proposal if enacted will.

The proposed change. Reduce the current 11700000 per person gift and estate tax exemption the unified exemption by approximately one half. 31 2025 and will return to the Obama exemption of 5 million adjusted for inflation.

Under the CARES Act QIP is now classified as 15-year property and eligible for 100 bonus depreciation through 2022 as it was originally intended. On October 28 2021 President Biden released his framework for the Build Back Better Act which notably did not include any of the estate tax or grantor trust changes that. Lothes Sep 24 2021.

The current exemption will sunset on Dec. The adjusted exemption in 2026 is projected to. Amr AlfikyThe New York Times.

The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. Basis represents for tax purposes the original cost or capital investment for a property. Additionally QIP will be subject to a 20.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Democrats Revised Tax Plan Includes Changes And Improvements Important To Real Estate And Other Pass Through Businesses The Real Estate Roundtable

Estate Tax Landscape For 2021 And Beyond

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

Winne Banta S Jonathan Kukin To Speak At Ort America Planned Giving Seminar Winne Banta

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

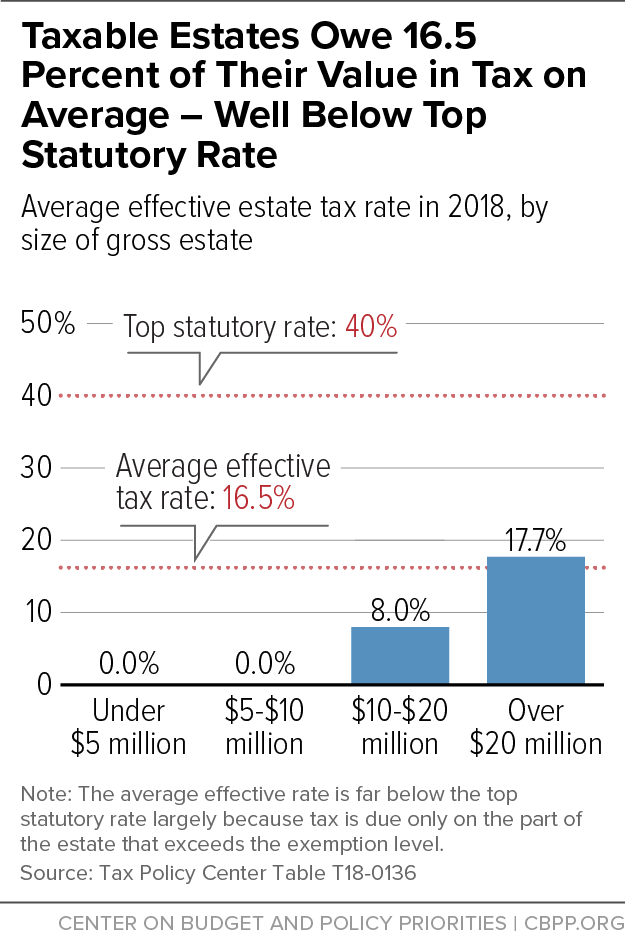

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Policy Basics The Federal Estate Tax Center On Budget And Policy Priorities

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

D C Estate Tax Exemption Reduces Significantly In 2021 Law Offices Of Clifford M Cohenlaw Offices Of Clifford M Cohen

Video Wise Money Decisions By Financial Harvest

2021 Reconciliation Bill Potential Tax Changes Round Table Wealth

Estate Tax Current Law 2026 Biden Tax Proposal

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

The Clock Could Be Ticking For Favorable Estate Planning Provisions Advisorpedia

What Is The U S Estate Tax Rate Asena Advisors

Estate Taxes May Be Amended Soon

State Corporate Income Tax Rates And Brackets Tax Foundation

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep